FOR IMMEDIATE RELEASE

Monday, October 7, 2024

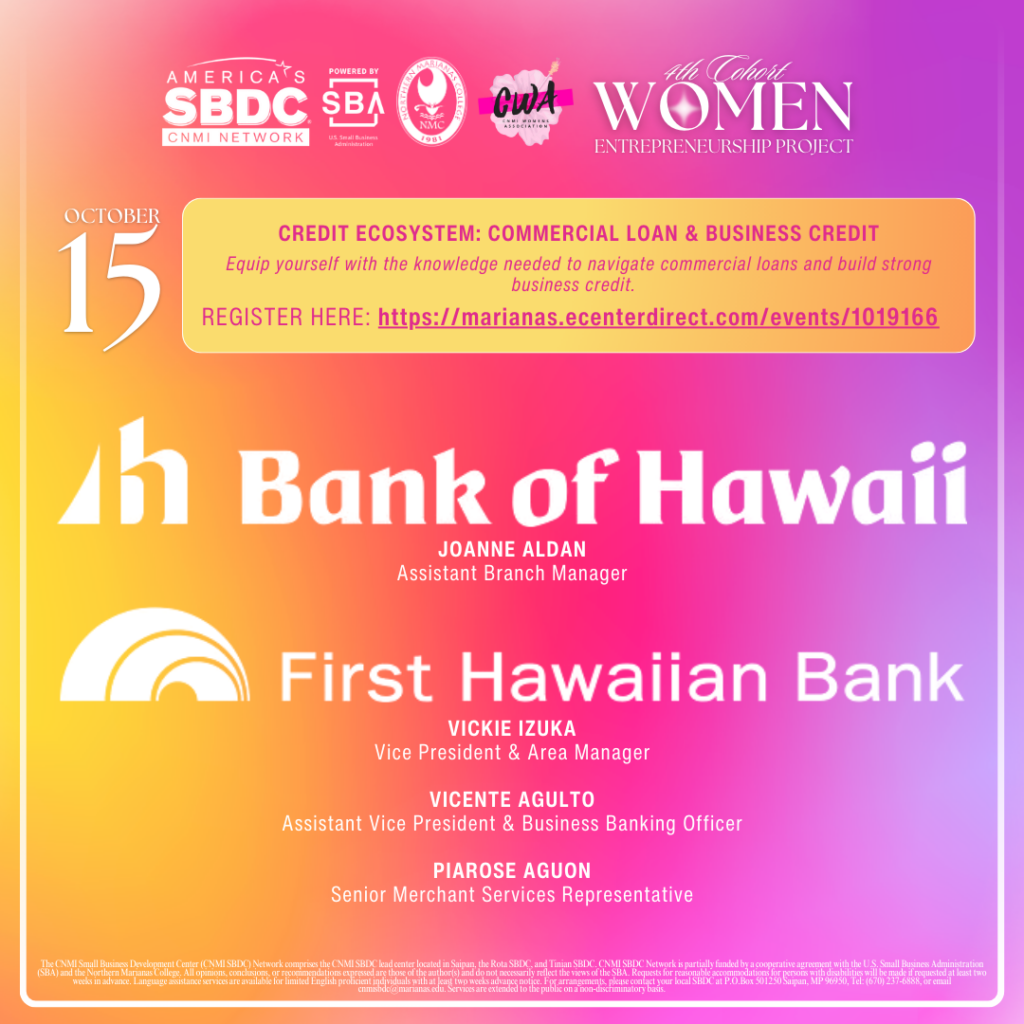

(Saipan, MP) The CNMI Small Business Development Center Network at the Northern Marianas College, in partnership with the Commonwealth Women’s Association, is excited to announce its speakers for its opening session “Credit Ecosystem: Commercial Loan & Business Credit” of the 2024 Women’s Entrepreneurship Project Cohort 4 training series slated to kick off Tuesday, October 15, 2024 and conclude on Friday, October 18, 2024. The training will be offered at the Northern Marianas College Library at its campus in As Terlaje, Saipan.

The opening session will consist of presentations featuring Joanne Aldan, Assistant Vice President and Assistant Branch Manager of the Bank of Hawaii and Vickie Izuka, Vice President & Branch Manager, Vicente Agulto, Assistant Vice President & Business Banking Officer, and Piarose Aguon, Senior Merchant Services Representative of the First Hawaiian Bank.

In the first half of Credit Ecosystem, Bank of Hawaii will be covering the ABCs of Credit to discuss the following highlights:

- Understanding the basics of credit

- Understanding credit reporting, credit scoring and the importance of having good credit history

- Knowing what to do if credit problems occur

Filling out a loan application can be intimidating. For the second half of the session, join First Hawaiian Bank and learn more about the business loan process and how to complete an application to help ease your mind in pursuit of accessing capital to realize your dream of becoming a business owner. Whether wanting to start a business or expanding your existing one, First Hawaiian Bank will walk you through the life of a loan application, and provide understanding of the underwriting process that goes into business loans. Presenters will feature insights into the bank’s merchant services where coverage on credit components important to share with clients will also be provided. Learn more about what bankers look for in suitable clients that can help drive your confidence in submitting that business loan application today.

The SBDC and CWA are excited to welcome back First Hawaiian Bank as repeat presenters and Bank of Hawaii as a new speaker to this year’s Women’s Entrepreneurship Project. Banking sessions are undoubtedly one of the program’s most anticipated training in the series as the program strives to continuously provide updated banking industry information while refreshing participants’ knowledge related to credit and the loan application processes.

“Financial institutions often provide a lifeline for our small businesses when faced with economic challenges. They also play a key role in helping small businesses thrive when they’re able to access necessary capital that can help in their expansion efforts. We are extremely grateful for the generous support and outstanding presentations we continue to receive for our clients from our banking resource partners,” shares Nadine C. Deleon Guerrero, Network Director of the CNMI SBDC.

Interested in signing up for this year’s cohort? Access the links below for the four-day training series:

October 15: Credit Ecosystem – https://marianas.ecenterdirect.com/events/1019166

October 16: Exploring CNMI SSBCI 2.0 – https://marianas.ecenterdirect.com/events/1019167

October 17: The Anatomy of the RFP – ttps://marianas.ecenterdirect.com/events/1019168

October 18: Consignment Symbiosis – https://marianas.ecenterdirect.com/events/1019169

Attendees must be a registered CNMI SBDC client, and interested individuals are able to register via phone or email. Certificates of Completion will be awarded to those who attend all four sessions. Participants who miss one session may still attend, but will not receive a certificate.

For more information, visit www.cnmisbdc.com or contact us at (670) 237-6888 / cnmisbdc@marianas.edu. Follow us on social media for the latest updates: Instagram @cnmisbdc and Facebook at CNMI Small Business Development Center Network.

The CNMI SBDC Network promotes a business-friendly economic infrastructure in the community, builds entrepreneurial capacity and financial literacy within that community, and provides current and nascent small businesses with the technical assistance, counseling, training, and support they need to innovate, adapt, and grow.

The CNMI Small Business Development Center Network (CNMI SBDC) Network comprises the CNMI SBDC lead center located in Saipan, the Rota SBDC, and Tinian SBDC. CNMI SBDC Network is partially funded by a cooperative agreement with the U.S. Small Business Administration (SBA) and the Northern Marianas College. All opinions, conclusions, or recommendations expressed are those of the author(s) and do not necessarily reflect the views of the SBA. Requests for reasonable accommodations for persons with disabilities will be made if requested at least two weeks in advance. Language assistance services are available for limited English proficient individuals with at least two weeks advance notice. For arrangements, please contact your local SBDC at P.O.Box 501250 Saipan, MP 96950, Tel: (670) 237-6888, or email adelpha.magofna@marianas.edu. Services are extended to the public on a non-disciplinary basis.

Social Media Caption:

Exciting Announcement!

Exciting Announcement!

The CNMI SBDC Network at Northern Marianas College and the Commonwealth Women’s Association proudly present the opening session for the Women’s Entrepreneurship Project Cohort 4 training series!

Join us from October 15-18, 2024, at NMC’s As Terlaje Campus, Saipan, as we kick off with the session “Credit Ecosystem: Commercial Loan & Business Credit” featuring:

Joanne Aldan – Assistant Branch Manager, Bank of Hawaii

Joanne Aldan – Assistant Branch Manager, Bank of Hawaii  Vickie Izuka, Vicente Agulto, and Piarose Aguon – First Hawaiian Bank

Vickie Izuka, Vicente Agulto, and Piarose Aguon – First Hawaiian Bank

Learn the essentials of credit, the business loan process, and more to help you access the capital you need to grow your business!

Sign up today for this valuable 4-day training:

Sign up today for this valuable 4-day training:

October 15: Credit Ecosystem

October 15: Credit Ecosystem  October 16: Exploring CNMI SSBCI 2.0

October 16: Exploring CNMI SSBCI 2.0  October 17: The Anatomy of the RFP

October 17: The Anatomy of the RFP  October 18: Consignment Symbiosis

October 18: Consignment Symbiosis

Visit www.cnmisbdc.com or call (670) 237-6888 for more details.  Don’t forget to follow us for updates:

Don’t forget to follow us for updates:

IG: @cnmisbdc

IG: @cnmisbdc  FB: CNMI Small Business Development Center Network

FB: CNMI Small Business Development Center Network

#WomenEntrepreneurship #SmallBusinessGrowth #CWM #CNMISBDC #BOH #FHB #BusinessTraining #CreditEssentials

– ### –